At TalentWoo, we continuously monitor industry reports to provide our clients with timely insights. The U.S. Industrial Real Estate Report offers a comprehensive overview of the industrial real estate landscape, highlighting sector-specific trends that have direct implications for talent acquisition and operational strategies.

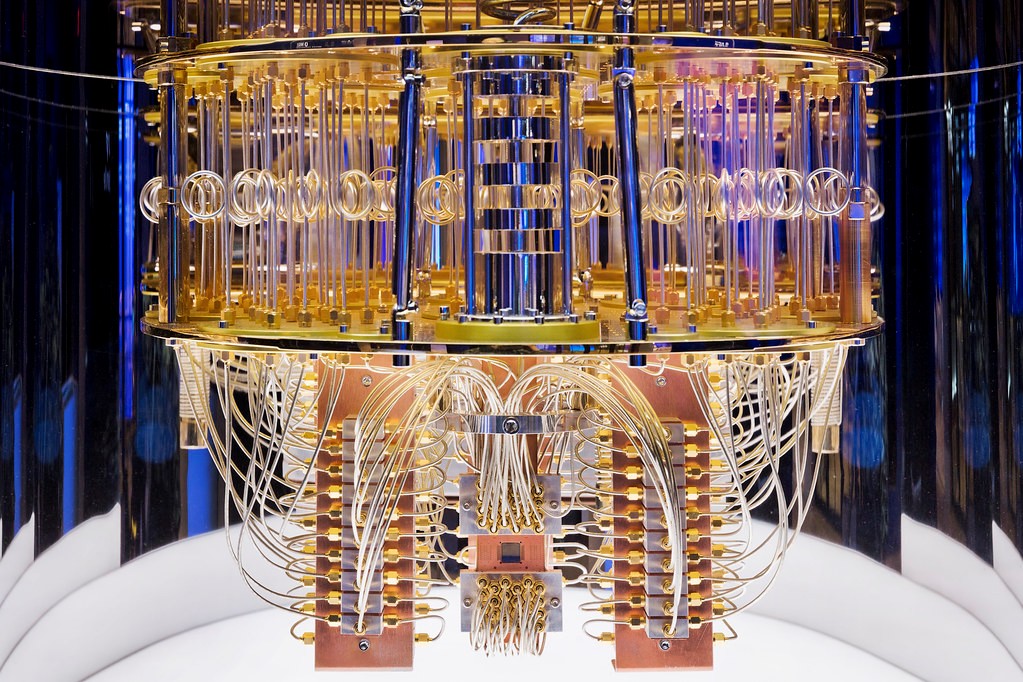

AI and the Data Center Surge: A Double-Edged Sword

The rapid advancement of generative AI technologies has sparked an unprecedented demand for data centers. Since the beginning of 2023, over 51 million square feet of new data center space—representing 23.6% of existing stock—have commenced construction.

However, this explosive growth is encountering headwinds. Major tech firms like AWS and Microsoft have recently paused or scaled back significant data center projects, citing capacity management concerns. Additionally, investor skepticism is mounting, with some questioning the long-term return on investment in the AI sector.

Beyond financial considerations, data centers face challenges related to power consumption, site selection, and community pushback. The substantial energy requirements and environmental impact of these facilities are prompting debates about sustainable development and resource allocation.

National Market Metrics: Vacancy and Rent Trends

- Vacancy Rates: As of April 2025, the national industrial vacancy rate increased to 8.8%, up 30 basis points from the previous month. This rise is attributed to a historic influx of new supply entering the market. However, with new supply deliveries beginning to taper off, vacancy rates are expected to stabilize in the coming months.

- Rental Rates: National in-place industrial rents averaged $8.49 per square foot in April, marking a 6.7% year-over-year increase. Notably, markets like Boston and Bridgeport posted some of the nation’s widest lease spreads, at $4.79 and $5.90 per square foot respectively, far surpassing the national average of $1.79.

Regional Highlights: Diverse Market Dynamics

Midwest: Markets such as Memphis, Kansas City, and Detroit experienced the slowest annual rent growth nationwide, with increases of 3.7%, 3.8%, and 3.9% respectively. Despite this, Chicago continues to lead the Midwest in industrial sales, with $1.9 billion in transactions during the first eight months of the year.

South: Southern markets like Atlanta, Dallas, and Miami are emerging as critical anchors for national supply chain operations. Atlanta added 29 million square feet of industrial space in 2024, with vacancy rates holding steady at 3%, reflecting extraordinary demand. Miami’s strategic location as a gateway for international trade, particularly with Latin America, gives it a unique advantage for industrial tenants needing distribution hubs.

West: Western markets remained resilient, with Los Angeles and Portland posting vacancy rates under 10%, despite rising supply. The San Francisco Bay Area led the country in industrial sales per square foot, at $460, followed by other California markets and New Jersey.

Talent Implications: Navigating a Transforming Landscape

The evolving industrial real estate landscape, driven by AI advancements and regional market dynamics, underscores the need for specialized talent:

- Data Center Operations: As the demand for data centers grows, professionals skilled in managing high-density IT infrastructures and ensuring energy efficiency are in high demand.

- Supply Chain and Logistics: The expansion of industrial spaces in key regions necessitates experts in supply chain optimization and logistics management to ensure seamless operations.

- Sustainability and Compliance: With increasing scrutiny on environmental impact, roles focused on sustainability practices and regulatory compliance are becoming essential.

Strategic Talent Acquisition with TalentWoo

The insights from CommercialEdge’s May 2025 report highlight the dynamic nature of the industrial real estate market. At TalentWoo, we specialize in aligning talent strategies with these evolving trends. Whether you’re seeking professionals to manage data center operations, optimize supply chains, or drive sustainability initiatives, our tailored recruitment solutions ensure your organization is equipped for success.

For a detailed analysis, refer to the full U.S. Industrial Real Estate Report.

Stay ahead in the industrial real estate sector with TalentWoo’s strategic talent solutions.