In a year of uncertainty and cautious optimism, the newly released NAIOP 2025 Economic Impacts of Commercial Real Estate report offers a powerful data-driven reminder of commercial real estate’s enduring influence. With $6.4 trillion in GDP impact and 31.9 million jobs supported through construction and operations in 2024 alone, the real estate sector remains a cornerstone of U.S. economic strength.

But beneath the headline numbers lie critical takeaways for real estate companies—and especially for the HR and talent leaders who must align workforce needs with shifting market dynamics. At TalentWoo, we help organizations across SFR, multifamily, commercial, industrial, and proptech verticals make sense of these macroeconomic shifts and respond with smart, agile hiring strategies.

Real Estate Construction Continues to Drive Jobs & GDP

Despite macroeconomic headwinds in 2024, construction activity contributed significantly to the economy:

- $2.2 trillion in direct construction spending generated

- $6.4 trillion total GDP contribution via multipliers

- 31.9 million jobs supported across all phases of development and operations

This underscores an important reality: while project starts may ebb, the labor needs don’t disappear—they shift. From project managers to tenant coordinators and asset analysts, organizations still need skilled professionals to keep assets running, plans moving, and portfolios optimized.

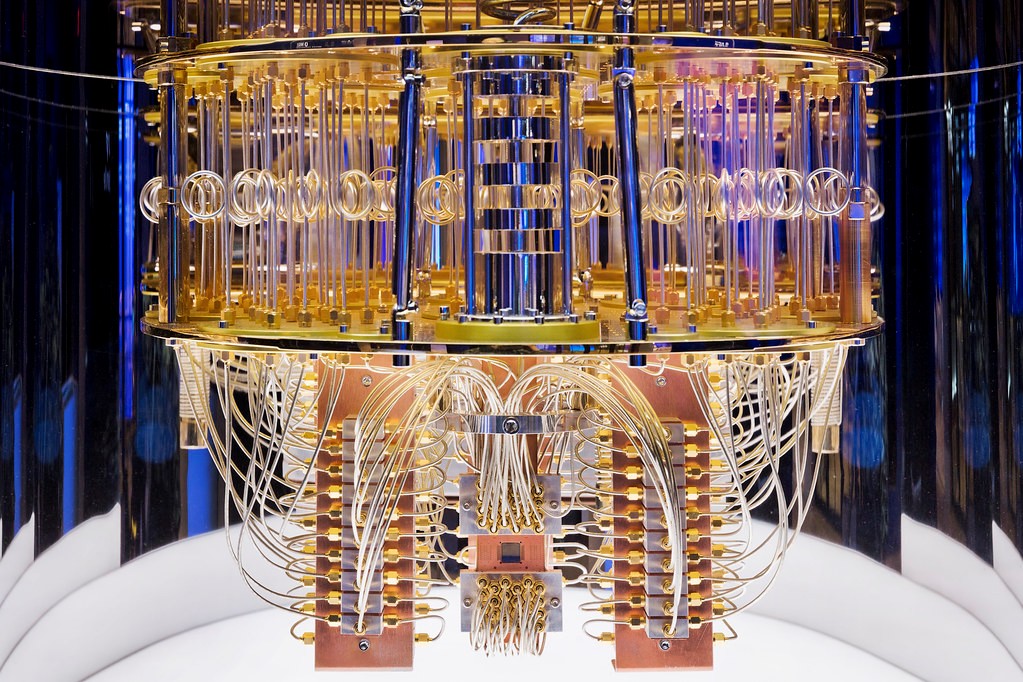

Office: Driven by Data Centers and Class A Demand

Office construction spending increased 8.5% in 2024, thanks in part to a 59% surge in data center development, which now comprises 34.4% of all private office construction. Companies are doubling down on Class A space to attract hybrid workers, while aging Class B/C inventory struggles.

Talent Implication: Leasing teams, facility managers, and IT-forward project leaders will be in demand as buildings are reconfigured to support hybrid use and technology integration.

Retail: Smaller, Smarter, Still Thriving

Retail rebounded in 2024 with a 2.2% increase in construction spending, focusing on small-format, experience-driven stores. Think Whole Foods, Nordstrom Local, and urban Targets. E-commerce is up (16.2% of all retail sales), but brick-and-mortar remains dominant—and increasingly blended with online channels.

Talent Implication: Employers will need regional managers, experiential retail designers, and proptech-savvy staff to connect the dots between physical and digital commerce.

Industrial: Reshoring, CHIPS Act, and a Coming Stabilization

Industrial construction saw a 14.2% drop in 2024—a breather after explosive growth in 2021–2022. But government incentives like the CHIPS and Inflation Reduction Acts have fueled reshoring efforts, especially for manufacturing and semiconductor facilities.

Talent Implication: The hunt is on for site supervisors, industrial engineers, and logistics talent—especially in the Southeast and Midwest.

Hiring for Agility: TalentWoo’s Contract Recruiting Services

When full-time hiring slows but business continues, TalentWoo’s contract recruiting model offers a right-sized solution:

- On-demand recruiters embedded within your team

- Deep expertise across SFR, commercial, multifamily, and industrial real estate

- Flexibility to scale up or down as markets shift

Case in Point: A Top 10 homebuilder needed urgent recruiting help during a regional expansion. TalentWoo stepped in with a contract recruiter, filled 100% of open roles in 90 days, and placed 9 new leaders—4 of whom were promoted within the year. See the full story »

What’s Next?

While real estate continues to evolve, one thing is clear: staffing models must evolve too. TalentWoo helps companies bridge talent gaps during times of transition—whether you’re navigating rising costs, capital constraints, or planning for future growth.